When negotiating over the telephone, be slower than usual to agree to new ideas or requests. You can always call back once you've considered how to say "yes" in exchange for some value.

By Marianne Eby

Deflategate continues to enlighten us -- not just about American football, or alleged scandals, or even the science of air pressure in balls in cold weather -- but about what happens when parties can’t reach a negotiated solution to their dispute. Last week opened with an appeals court reinstating New England Patriots' quarterback, Tom Brady's 4-game suspension, and ended with a court filing by the Brady team. The many plays that have occurred and the ones yet to come demonstrate the perils of litigation, the power of having a Plan B or BATNA, and that there is still benefit to and time for a negotiated solution.

When my colleague at Watershed Associates, Leslie Mulligan, wrote about Deflategate in July and again in September 2015, she quite rightly predicted that we have not seen the last of the NFL v. Brady case. She exposed the various stakeholders and their potential interests – why they might want what they are demanding. She also talked about the parties’ Plan Bs, or BATNAs (best alternatives to a negotiated agreement) – what moves they might make if no agreement is possible.

What Leslie couldn't know then was how the 2015 NFL season or the appeal of a lower court decision would ultimately play out, and what would be the next moves by parties who so far had not found common ground on which to negotiate a resolution of their differences.

The parties in court are technically the National Football League (NFL) Management Council, and the National Football League Players’ Association (NFLPA). The parties who everyone talks about are NFL Commissioner Roger Goodell and the star quarterback Tom Brady. Brady’s football team, the New England Patriots, are involved as they certainly care about winning games (and the revenue) that could be impacted by a suspension of Brady for his alleged role in the scandal. Roger Goodell is under great pressure to keep the League’s owners satisfied with his leadership decisions and equal treatment among teams, so the other teams’ owners are major stakeholders. And of course the NFLPA needs to demonstrate that it will protect the rights of the players, like Brady.

These parties chose to execute their litigation BATNA to resolve this dispute rather than negotiate a solution. As a former litigator myself, I know well the perils of litigation. Negotiation can be win-win or win-lose, but litigation is almost always lose-lose, and it has played out exactly that way in Deflategate.

The parties’ BATNAs in and outside the courthouse have continued to unfold. Last week a panel of the U.S. Court of Appeals for the 2nd Circuit reinstated the 4-game suspension issued by NFL Commissioner Roger Goodell against the New England Patriots' star quarterback, Tom Brady. This is probably not the final play in what has been a drama filled game of questionable tactics.

Unlike litigation, negotiating a settlement of their dispute had the potential to put the solution within the parties’ control. They could have mutually determined how they would be perceived, their investment of resources (15+ months, lawyers fees, personal time and stress) and the ultimate outcome. Litigation, on the other hand, held the potential to declare a final winner and a loser, raising the stakes significantly. Sometimes implementing the BATNA of litigation is the only way to satisfy our interests, but it usually comes at great cost to both parties.

There are always winners and losers, but it’s the Interests that underlie the wins and losses that really matter.

With commentary from me on what really mattered throughout Deflategate, let’s review Brady's win-loss record on and off the field, and in and outside the courthouse, and what was really at issue in each stage of this game since January 2015.

Brady wins

Jan 18, 2015 - Tom Brady leads the Patriots to win 45-7 in the AFC Championship game.

►What matters? Brady is a star football player and key to the Patriots' win record. A defeat of this magnitude certainly doesn't come about from pure ball tampering, but it does leave others wanting pay-back.

Brady loses

Jan 23, 2015 – NFL announces investigation into allegedly deflated balls (or as it turned out, possibly one ball); Deflategate is born!

►What matters? NFL’s interest here is ostensibly the integrity of the game.

Brady wins

February 1, 2015 - Midway through the 4th quarter of the 2015 Super Bowl, the Patriots are down by 10 points, but Brady isn't resigned to lose. Brady leads the Patriots to victory as Super Bowl XLIX champions.

►What matters? Brady and the Patriots don’t need deflated balls to win.

Brady loses 3 consecutive moves

May 2015 – NFL issues harsh penalties. Brady gets a 4-game suspension to take place in the 2015 season for his alleged role in Deflategate. The NFL also imposes a $1,000,000 fine on the Patriots and takes away the team’s first and fourth round draft picks.

►What matters? The official interests seem to be that the NFL won’t cover up even alleged complicity by one of its superstars and that it doesn’t “play favorites” with the teams. But there is a behind the scenes interest as well – that Goodell is beholden to all teams’ Owners and they haven’t forgotten past cheating by the Patriots.

June & July 2015 - Arbitration of an internal NFL appeal: NFL Commissioner Goodell, acting as the arbitrator, denies Brady’s appeal and upholds the suspension.

►What matters? The NFL’s power to conduct the investigation as it saw fit and issue penalties as it deems appropriate are paramount to its leverage with the players’ association.

Minutes later? Beating Brady and the NFLPA to the courthouse door, the NFL files a lawsuit in US District Court in New York to affirm the arbitrator’s decision.

►What matters? NFL files in NY to avoid ending up in a Minnesota federal court that has been more friendly to players.

Brady wins 3 consecutive moves

Brady is unstoppable throughout the 2015 NFL season.

Brady is unstoppable throughout the 2015 NFL season.

Sept 3, 2015 – Federal District Court's Judge Berman vacates Goodell's decision and rules in favor of Brady. The Judge urged the parties to settle. Berman finds legal deficiencies that were fatal to the NFL’s suspension (inadequate notice to Brady of the possible punishment, lack of access to investigative files, and not letting Brady examine the lead investigator).

►What matters? Goodell’s conduct (rulings and decision) at the hearing are deemed unfair and in breach of the collective bargaining agreement.

The NFL didn't try to stop Brady from playing in the 2015 season, and the Patriots ultimately secured the AFC East Division title.

Around the same time, the academics finally weigh in. MIT professor John Leonard releases his study of the data – the math and the football – and he concludes that “no deflation occurred and the Patriots are innocent. It never happened.” It’s all over YouTube: MIT Professor Debunks Deflategate. And Harvard Business School has around a thousand students grapple with a case study about Deflategate, developed by professors Marco Iansiti and David Sarnoff. Iansiti comments:

“The data are the data. A lot of the proceedings are now frankly more about the power relationships between different stakeholders in the whole environment, and less about what actually happened with the bloody footballs.”

►What matters? Brady and the Patriots have multiple moral victories that no court can erase. It’s clear that Deflategate is all about the power of the organizations involved, and litigation, as is often true, is only a vehicle to increase or avoid losing that power.

Brady loses

December 22, 2015, the NFL files an appeal to the US Court of Appeals for the 2nd Circuit. And in January Brady and the Patriots lose the AFC Championship to the eventual 2016 Super Bowl champions, the Denver Broncos.

►What matters? The NFL’s power to enforce its decisions is paramount to its leverage with the NFLPA, regardless that the facts favoring Brady are mounting. On appeal, the law matters (not the facts), and winning on the field is as unpredictable as court.

Brady wins

March 2016 – Brady renegotiates his salary to include a $28M signing bonus for his $60M multi-year contract.

►What matters? Brady reduces his year-1 salary to $1M and thereby ensures that he protects a large portion of his earnings with a signing bonus the NFL can’t touch in the event that the 4-game suspension is reinstated on appeal, after the questioning at the hearing on March 3 didn’t bode well.

Goodell hedges on whether the NFL will enforce Brady’s suspension if the NFL is successful on appeal.

“That is not an individual player issue,” Goodell said then. “This is about the rights we negotiated in our collective bargaining agreement. We think they are very clear. We think they are important to the league going forward and we disagree with the district judge’s decision.”

►What matters? The NFL’s real interest is in protecting its rights under collective bargaining agreements; the facts aside and well beyond the implications for Tom Brady.

Brady loses

Apr 25, 2016 – US Court of Appeals for the 2nd Circuit in New York issues decision overriding Judge Berman and reinstating the Brady’s suspension, with one dissenting opinion.

►What matters? Judge Berman’s improper application of the law in overturning Goodell acting as arbitrator of his own decision. The NFL’s power in collective bargaining is re-established.

Brady wins

Brady holds the #1 spot for sales of NFL players merchandise for the 2015-16 season.

►What matters? Since his initial suspension, Brady surpassed both Quarterback Peyton Manning’s merchandise sales even though Manning led the Denver Broncos to be Super Bowl champs in 2016, and the merchandise sales for Russell Wilson, quarterback for the Seattle Seahawks, who held the #1 spot for the previous 2 years. The players get 2/3 of the money from the merchandise sales. One could conclude from this that Deflategate improved Brady’s reputation rather than hurt it.

What are the parties' next moves?

Who wins or loses next? More importantly, what really matters?

The NFL wants happy fans, the assurance of power in its collective bargaining agreements with the players’ union, and increased revenue. The NFL has lost a great deal of respect to protect those interests. Tom Brady is by all measures a star football player, but he wants to go down in history as an honest football legend, not to lose income, and as a winner on and off the field.

Will the parties rely again on the strength of their BATNAs, or will they finally see that their interests can be addressed in a negotiated agreement – that they can move from lose-lose to win-win?

Here are the 3 possible next plays in Deflategate:

has a great chance of success.

has a great chance of success.The NFL has won the legal issues at this juncture, and may want to avoid any risk of a further appeal, given the strong dissent by Judge Katzmann, who found the Commissioner breached his authority.

Brady doesn’t have much more to gain even if he wins the next court decision, given that his popularity actually increased during Deflategate, the Patriots re-signed him and helped him avoid most of the financial hit a suspension will impose, and there are many experts who question not just the NFL’s actions during Deflategate, but the evidence itself, leaving Brady’s integrity largely intact.

Of course Brady and the Patriots want to win football games, and the team’s chances of reaching the playoffs in the upcoming season are increased if Brady plays those first 4 games. But that outcome is attainable in a settlement, and does not need a court decision. We don’t know what are the parties’ next moves, but we can be pretty sure everyone wants to see more of Tom Brady playing football, especially when he may not have many seasons left.

By Thomas Wood

Sometimes it seems it will take a magician to get two deadlocked negotiators back to the bargaining table—but sometimes it just takes a basketball player and his crazed fans. Such was the case earlier this year in New York City when a seemingly intractable pricing dispute between a cable TV provider and a regional sports network fell victim to “Linsanity,” the mania for a Knicks rookie guard shared by millions of New Yorkers, including the state’s governor and city’s council chair. We can learn from this lesson in how outside factors can affect the course of negotiations—and how wise negotiators keep an eye on the wider world outside the negotiating room.

According to Adweek magazine, MSG Entertainment—which owns the Knicks, along with several other Gotham sports franchises— couldn’t come to terms with Time Warner Cable about how much the sports network would charge the cable operator to televise games. As both parties blamed each other in the media, MSG played hardball and yanked its games from Time Warner’s cable system in New York, depriving millions of local fans of their hometown teams.

There was some grumbling, but no organized resistance until an undrafted Harvard graduate named Jeremy Lin took the floor for the generally hapless Knicks and set the sports world on fire. With Lin racking up impressive stats, his team went on a seven-game winning streak, and this Asian-American superstar athlete was a force to be reckoned with. Although Lin’s feats were followed around the world, millions of Time Warner subscribers living within driving distance of Madison Square Garden couldn’t watch their new hero on TV. According to the New York Times, residents of Manhattan’s Chinatown, especially—who had adopted Lin as one of their own—were up in arms about the basketball blackout.

Seeing some easy points to score on their own, local politicians soon got in on the act. New York governor Andrew Cuomo and New York City Council chair Christine Quinn both exerted pressure on MSG Entertainment chairman James Dolan and Time-Warner Cable Chairman Glenn A. Britt, with Quinn threatening to pull them in front of a council inquiry. After no talks for over a month, the two sides met on a Monday and had a deal by Friday, brokered by the New York Attorney General.

Neither side would reveal terms of the agreement. Perhaps both were satisfied with the deal, and only needed outside prompting to get them past their combative attitudes. But maybe one side had to swallow an unpalatable agreement because of the exterior pressure. In either case, a private negotiation went public because the participants failed to recognize the impact their impasse would have on third parties—and how those outside parties would react.

Whether it’s suppliers, customers or politicians, outsiders often keep close tabs on a negotiation that will affect their interests, and are prepared to defend those interests. The smart negotiator, like the savvy point guard in basketball, maintains awareness of all the players in the game.

By Marianne Eby

I admit to not knowing much about football despite my son's love of the game. To me it looks more like a bunch of athletes who get paid a lot of money to ram into each other until one team trounces the other. Let's face it - I’m a negotiator who believes in win-win more than win-lose. So it’s no surprise that I was paying more attention to the NFL Super Bowl XLVIII advertisements on Sunday than to the game. And what did this super negotiator see? The deal of the century!

And I’m not talking about one of the many deals in the $10B enterprise that is the National Football League (NFL). I'm talking about the now famous Cheerios commercial. Sunday’s NFL Super Bowl XLVIII Cheerios commercial taught in 30 seconds (and paid $4M for the privilege of doing so) what every good negotiator knows - trades come in all breeds.

Here’s how Forbes describes that commercial, a father at the breakfast table with his little girl, Gracie, using the addition of one Cheerios at a time to demonstrate that there is going to be a new family member (and thus one more Cheerio added to the pile):

“The Epiphany: After the baby brother announcement, the subtle pregnant pause. Gracie’s actor qualities rise to impressive levels to tug at your heart at this point. The frown-pause moment is followed by the epiphany, “and a dog”. Translated: ‘If he’s sweet talking me like this, he must want my approval. That must mean I have some bargaining power – (and what do I have to lose, the little guy his coming anyway). I can use this event to broker and barter a deal. If I have to put up with a babbling infant that cuts into my time and resources, I can now use my unprecedented leverage get what I want in return.’ ”

Opportunities to trade come in all sizes and shapes and sometimes out of the blue, so seize them when you can and everybody wins! The little girl seizes the moment and in her own way (by adding a Cheerios to the family pile of course) makes it clear that family tranquility has a price – a puppy she can call her own. Caught off guard, the dad declares “Deal.”

And Cheerios gave a final negotiation lesson before its 30 seconds of air time was up – the camera turns to the pregnant mom, whose priceless facial expression makes it clear that dad forgot to check with his stakeholders before closing the deal.

The NFL is full of high stakes deal-making in the mega-millions, but this deal has lessons for players, owners and viewers alike. Think about what the other side will ask for before you start negotiating, seize opportunities to get what you want, and always know your stakeholders’ interests before you close the deal.

By Thomas Wood

On World Food Day, October 16, 2015, will you be drinking China’s famous Huiyuan fruit juice or the iconic Coca-Cola?

At Expo Milano 2015, which closes this month, each showcased brand proudly stands alone as a key player in the planet's food. Not so long ago, however, the two companies were on the road to a blissful acquisition of China Huiyuan Juice Company by Coca-Cola. What happened to the deal, and what can we learn from the failed negotiations of these beverage giants?

Expo Milano 2015 offers a “platform for the exchange of ideas and shared solutions, stimulating each country’s creativity and promoting innovation for a sustainable future.” This sounds like a phrase out of our negotiator’s playbook! But Expo Milano of course is about food and its sustainability on our planet.

Coca-Cola is the Official Soft Drink Partner of Expo Milano. Huiyuan, China's largest juice manufacturer, is Expo Milano's Official Partner in the beverage fruits, legumes and spices cluster. It seems fitting that these two beverage giants each hold their own at the world’s food exposition, but I am reminded of an “almost event” in 2009, when the two were in talks for Coke to acquire Huiyuan as part of Coke's expansion in China -- a negotiation of shared ideas and solutions.

To Coke executives, the deal seemed like a perfect match. With 35 existing factories in China at the time, producing everything from soft drinks to milk tea, Coke had a long tradition of succeeding in the local market. After many negotiations, executives at Huiyuan had agreed to the deal, which led Coke to announce plans to commit an additional $2 billion to its presence in China over the next three years. Coke officials had proceeded adeptly from the start by investing time and energy into building relationships with executives at Huiyuan, as evidenced by the Chinese company’s major shareholders endorsing the merger. The business world was shocked when just a few weeks later, the Chinese government blocked Coca-Cola’s proposed $2.3 billion acquisition of Huiyuan in March 2009.

What scuttled the deal? Why had Coca-Cola been caught by surprise? The answer lies in Coke’s fundamental miscalculation of critical stakeholders’ interests – the Chinese government as the ultimate regulator of business in China, and the Chinese consumer.

Although the deal made financial sense for the two companies – one source close to Coca-Cola described it as a "marriage made in heaven,” regulatory officials in Beijing were looking at more than the bottom line. By 2009, Huiyuan had become a high-profile national brand, and its proposed sale to a US multinational had aroused tremendous opposition in local media outlets and online chat rooms.

Huiyuan’s founder and CEO also set off a firestorm after declaring that he was “selling [the company] like a pig,” with more than 80% of respondents opposing the deal on Xinhua, China’s state-owned news agency. With public sentiment turning increasingly against the deal, Beijing’s Ministry of Commerce felt comfortable and even empowered to scuttle the merger.

Beijing’s official rationale was that the deal would reduce competition. Many analysts observed, however, that Chinese officials simply believed that the public relations impact of approving the deal wasn’t positive enough to overcome the downside of creating an exception to China’s new anti-monopoly policy. No deal was therefore a better option than a deal that could be portrayed as a symbolic defeat for Chinese business. And therein lies the stakeholders' real interests: national pride in Chinese industry. No deal was sustainable if it didn't address these key stakeholders' interests.

Given its experience in the Chinese market, certainly Coke officials knew of the possibility that the Ministry would reject the deal. Coke probably did not expect, however, that Beijing would give in to public opinion and forego Coke's promised expansion in China. Coke may even have been blinded by its amicable relationships with Chinese companies.

What could Coca-Cola have done differently?

Coke’s negotiating team should have focused more on Huiyuan’s stakeholders – all of them, not just inside Huiyuan as its negotiating partner. Stakeholders who aren't at the bargaining table can crash the best-laid plans. Coke’s negotiating team could have brainstormed ways to adjust its offer in light of Beijing’s constituents’ reactions. Coke could have designed a campaign that would embolden Chinese national pride in the Huiyuan brand, rather than discourage it. It is difficult to believe there wasn’t a way to structure the deal that might have assuaged the public outcry, and even bolstered Chinese national pride.

Although Coke had developed close ties with Huiyuan officials, it was still at the mercy of the Chinese Ministry of Commerce. Earlier efforts to learn what would matter to the Ministry of Commerce on this front may have helped Coke succeed – or at least could have helped it avoid an expensive and time-consuming acquisition strategy that ultimately proved futile. And here we are 6 years later, with two strong beverage giants on the world food stage. Be sure to visit them at Expo Milano 2015.

By Leslie Mulligan

As the war in Ukraine expands and intensifies, we watch the sickening devastation and ask how can this be happening – has Vladimir Putin gone mad? The horror inflicted on innocent Ukrainians is so shocking, one might conclude that Putin has gone over the edge and lost touch with reality. Rational people wonder: why is he doing this, and can he be reasoned with to negotiate a diplomatic resolution to this nightmare?

Putin’s current position is clear – he presented the US and NATO his list of security demands in December 2021, including a guarantee that Ukraine never enters NATO and that NATO rolls back its military footprint in Eastern and Central Europe. At that time, his BATNA (best alternative to a negotiated agreement) was apparent - invading Ukraine (he has never truly ascribed to Ukraine’s sovereignty.) Negotiations had barely begun in January when Putin executed his BATNA. Ukraine and Russia were at war. And shortly after the invasion, Putin ratcheted up the rhetoric, threatening an even more terrifying BATNA – use of nuclear weaponry. The stakes are higher than ever for the West now, as Ukraine bears the brunt of this savagery.

his BATNA (best alternative to a negotiated agreement) was apparent - invading Ukraine (he has never truly ascribed to Ukraine’s sovereignty.) Negotiations had barely begun in January when Putin executed his BATNA. Ukraine and Russia were at war. And shortly after the invasion, Putin ratcheted up the rhetoric, threatening an even more terrifying BATNA – use of nuclear weaponry. The stakes are higher than ever for the West now, as Ukraine bears the brunt of this savagery.

Is Putin rational and should we negotiate with him at all?

Experts within the intelligence and national security community warn against viewing Putin as a madman. In early March, a veteran former CIA operative said of Putin, “He may have made a miscalculation, and many of his beliefs are wrong, but he is rational, consistent, and ruthless.” That ruthlessness is on full display as innocent Ukrainians suffer his brutality, resulting in a massive humanitarian crisis with more than 3 million refugees fleeing their country.

We know Putin’s position, but what are his interests – his underlying motivations. Skillful negotiators realize there is often more than one way to solve a party’s real concerns – why they want what it is they’re asking for – not just the position they put on the table. In negotiations, those concerns are called “Interests” and must be addressed for a sustainable resolution. In collaborative negotiations, parties address both sides’ Interests to create more value overall. Clearly, the situation in Ukraine does not invite collaboration – and yet we must still come to the table and craft a negotiation strategy that resolves this nightmare. Compromise, a less ideal strategy than collaboration, may not feel good but must be explored.

What are Putin’s Interests?

If we focus just on President Putin, what are the Interests in play, underpinning his position? From his remarks on the world stage, Putin is clearly motivated by the paramount "goal of regaining the importance in the world the Soviet Union used to hold - and restoring Russian pride." Putin came of age as a young KGB operative during the Soviet era, when the USSR was the counterweight to the power of the West, namely the US. That is how he defines greatness - regaining the power of the former Soviet Union.

If we focus just on President Putin, what are the Interests in play, underpinning his position? From his remarks on the world stage, Putin is clearly motivated by the paramount "goal of regaining the importance in the world the Soviet Union used to hold - and restoring Russian pride." Putin came of age as a young KGB operative during the Soviet era, when the USSR was the counterweight to the power of the West, namely the US. That is how he defines greatness - regaining the power of the former Soviet Union.

After the Berlin Wall fell and the USSR dissolved, Putin mourned “the national humiliation of a powerful state simply imploding”, notably not the “human cost or material tribulations ”. To Putin, the decades since the collapse of the USSR have not been kind to Russia. Fiona Hill (a NSC advisor to President Trump and former National Intelligence officer on Russia to Presidents Bush and Obama) gave an interview to the New York Times earlier in March, noting that Putin has "this mentality that Russia is always under siege, its leaders are always under siege."

Upon becoming the President of Russia in 2000, Putin was the embodiment of that greatness and the link between modern times and the Russian czars and czarinas that first achieved Russian prominence and pride. Putin’s real Interests then appear to be safeguarding his legacy as the restorer of Russia to its glory - reconstitution of the grandeur of the Soviet Union. Carlos Lozada wrote eloquently recently in the Washington Post: “Russia’s glory is his goal, but Putin’s own power is always the convenient means.”

If this crystallizes Putin’s Interests, can they be effectively addressed via negotiations or are other means necessary (and already in play)? Notably, addressing Interests works when dealing with most rational negotiators. But is Putin rational or irrational?

Putin rational or irrational?

Irrational negotiators act against their own Interests

Irrational negotiators appear to act against their own interests in the face of good information. Is Putin acting against his own Interests? Reflecting on the siege mentality Fiona Hill noted, is it real or imagined, or a major miscalculation on Putin’s part? Peter Baker at The New York Times reported back in March of 2014 that German Chancellor Angela Merkel shared her insights on Putin with President Obama, “that after speaking with Mr. Putin she was not sure he was in touch with reality, people briefed on the call said. 'In another world,’ she said."

Both rational and irrational negotiators fall prey to miscalculations.

So, is Putin miscalculating because he is misinformed? Stephen Kotkin, the renowned scholar of Russian history and Fellow at the Hoover Institution, was interviewed recently by David Remnick for The New Yorker and stated that Putin “is not getting the full gamut of information. He’s getting what he wants to hear. In any case, he believes that he’s superior and smarter.” This is a potentially catastrophic problem with despots as evidenced by current events.

Putin addressed the Kremlin on the eve of the Ukrainian invasion with the rationale for what would soon befall Ukraine. One foreign policy analyst described it as a "resentful diatribe" that highlights his view of the deceit of the West in its approach to Russia. But the analyst underscores that “Putin was not being irrational.” In fact, it showcases how his “worldview is taking him into conflict”.

Kotnick continues, “war usually is a miscalculation. It’s based on assumptions that don’t pan out, things you believe to be true or want to be true.” That is playing out in real-time in Ukraine. Putin over-estimated his own military capability, assuming Kyiv would fall swiftly - a few days and a puppet regime could be installed. And he wildly under-estimated the fierceness and strength of the  Ukrainian resistance. And then there is the unity of the western democratic powers – President Zelensky inspires the West with his steely leadership. In Zelensky’s address to the U.S. Congress, he evoked the US’ history in Pearl Harbor and 9-11 to urge its increased involvement. Western powers have come together to inflict economic war on Russia, but also to buttress the Ukrainian forces with weapons and support – whether significantly more support is forthcoming remains to be seen, as the West has thus far rebuffed the idea of a no-fly zone over Ukraine. Regardless of Western maneuvering, Putin is discovering the danger of unverified assumptions; he has had to reach out to China to overcome Russia’s military preparedness issue - in hopes that China will provide material support. It is imperative to be crystal clear on what is known/unknown, and what is assumed, as you prepare for negotiations, let alone warfare.

Ukrainian resistance. And then there is the unity of the western democratic powers – President Zelensky inspires the West with his steely leadership. In Zelensky’s address to the U.S. Congress, he evoked the US’ history in Pearl Harbor and 9-11 to urge its increased involvement. Western powers have come together to inflict economic war on Russia, but also to buttress the Ukrainian forces with weapons and support – whether significantly more support is forthcoming remains to be seen, as the West has thus far rebuffed the idea of a no-fly zone over Ukraine. Regardless of Western maneuvering, Putin is discovering the danger of unverified assumptions; he has had to reach out to China to overcome Russia’s military preparedness issue - in hopes that China will provide material support. It is imperative to be crystal clear on what is known/unknown, and what is assumed, as you prepare for negotiations, let alone warfare.

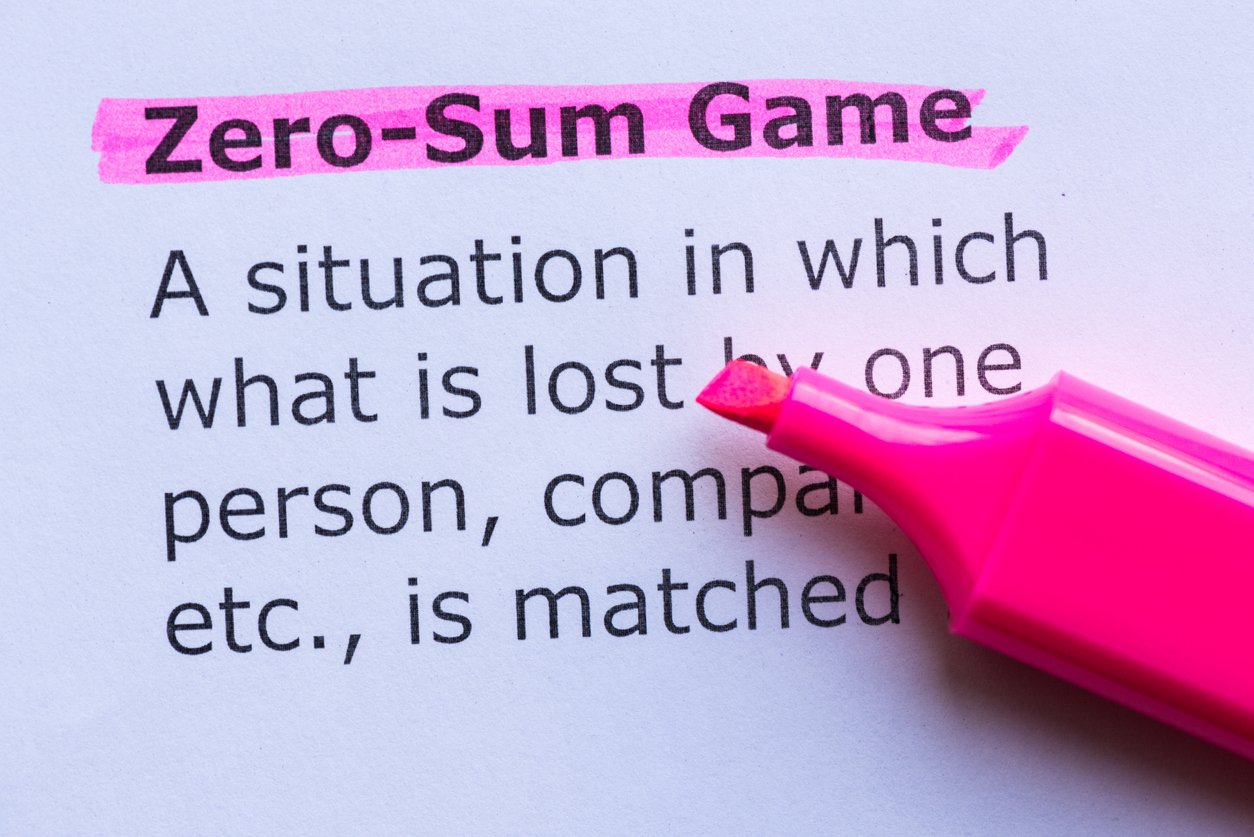

Putin’s penchant - Zero Sum game negotiating

The Insider described Putin’s view of negotiating with international partners: he sees “foreign policy as a zero-sum game — a gain for one side comes at the expense of its opponent”. The West perceives itself as more typically pursuing strategic, collaborative negotiations, where mutually beneficial gains can be achieved. Yet we must still negotiate with President Putin despite the opposing approaches. As the CIA operative noted, “he is behaving rationally within the confines of a fundamentally irrational set of beliefs.” At his core, he is acting true to his personal Interests and what he believes to be Russia’s over-arching Interests. In this situation, we should treat Putin as a rational negotiator and work to prove his assumptions wrong before he will come to the table with any true intent to negotiate in good faith.

The Insider described Putin’s view of negotiating with international partners: he sees “foreign policy as a zero-sum game — a gain for one side comes at the expense of its opponent”. The West perceives itself as more typically pursuing strategic, collaborative negotiations, where mutually beneficial gains can be achieved. Yet we must still negotiate with President Putin despite the opposing approaches. As the CIA operative noted, “he is behaving rationally within the confines of a fundamentally irrational set of beliefs.” At his core, he is acting true to his personal Interests and what he believes to be Russia’s over-arching Interests. In this situation, we should treat Putin as a rational negotiator and work to prove his assumptions wrong before he will come to the table with any true intent to negotiate in good faith.

Must we provide a bridge or an off-ramp to Putin?

What can seasoned diplomats do next in this tragic situation? Do we have to provide Putin a way to “save face”?

World leaders are wielding myriad tools of influence as they try to resolve this situation swiftly and peacefully. Power is on full display by Russia, the West is implementing crippling  sanctions as a financial lever, Ukraine is certainly trying to persuade the West to enter the fray more boldly, and negotiations are ongoing - both between Ukraine and Russia but also between President Zelensky and NATO countries. Other stakeholders are exerting influence too - as China and myriad global oil producers factor in, directly and indirectly. US President Biden and Chinese President Xi Jinping held an hour-long telephone call to get clear on the implications of China wading into this situation - China’s influence will certainly impact what happens next in Ukraine.

sanctions as a financial lever, Ukraine is certainly trying to persuade the West to enter the fray more boldly, and negotiations are ongoing - both between Ukraine and Russia but also between President Zelensky and NATO countries. Other stakeholders are exerting influence too - as China and myriad global oil producers factor in, directly and indirectly. US President Biden and Chinese President Xi Jinping held an hour-long telephone call to get clear on the implications of China wading into this situation - China’s influence will certainly impact what happens next in Ukraine.

Encouraging signs at the negotiation table have recently come from both Ukraine and Russia, but there are still some momentous hurdles to overcome. In Putin’s most recent televised appearance, his rhetoric ratcheted up again - he has tended to double down when he feels his position may be weakened. A peaceful end is not yet in sight. To prevent a tragedy like this in the future, some bridge to this elusive peace must be considered.

Stay tuned for future posts that address these dynamics in more depth: how will other players influence the outcome, the preservation of Western Interests, how public perceptions shape the narrative, and what other levers might be pulled at this historic negotiation table with profound implications.

Please provide us with some details and we will be in touch soon!